Reporting Charitable Contributions on Client Tax Returns Explained

4.8

(309) ·

$ 3.50 ·

In stock

Description

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

Tax Deduction Definition: Standard or Itemized?

Charitable deduction rules for trusts, estates, and lifetime transfers

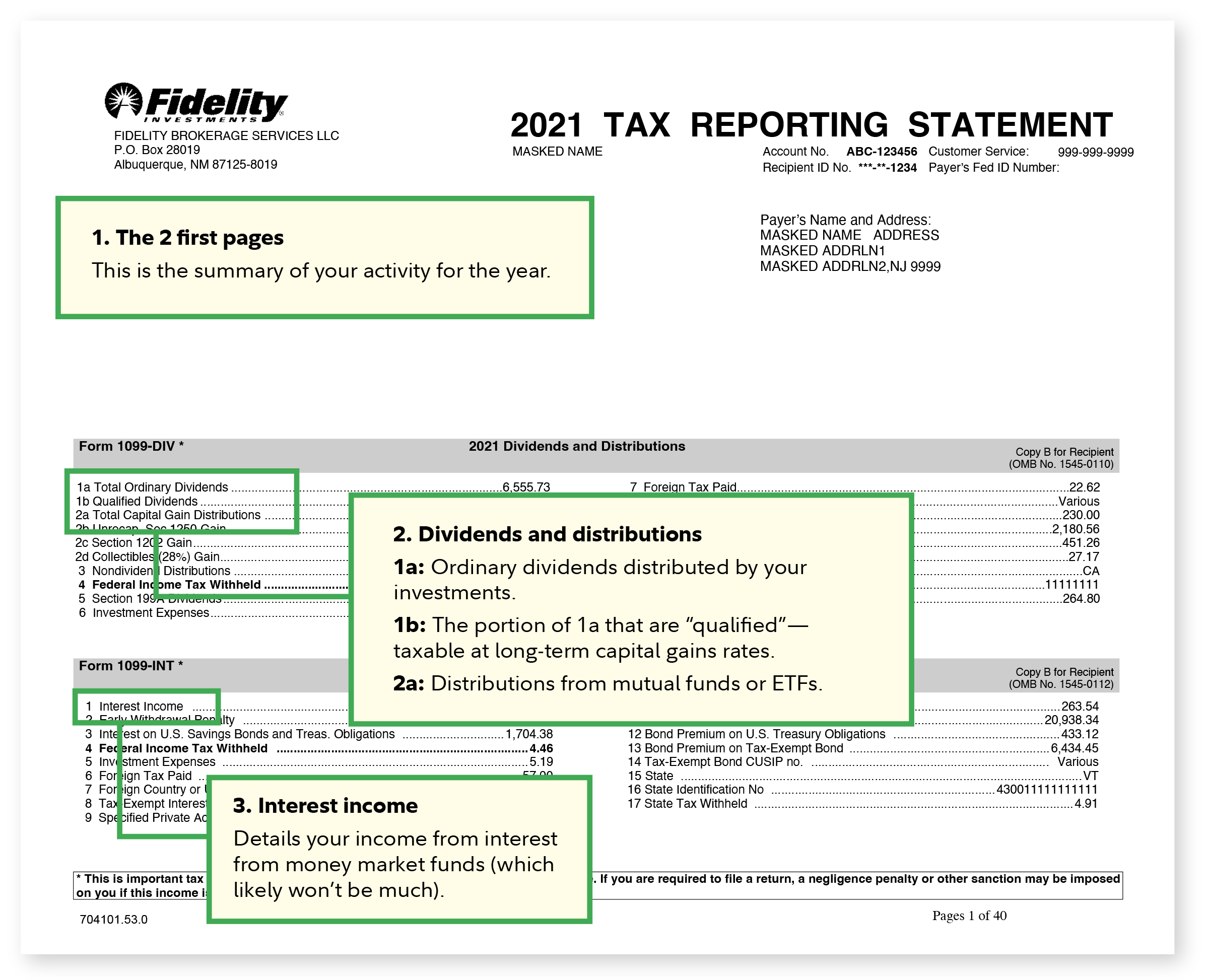

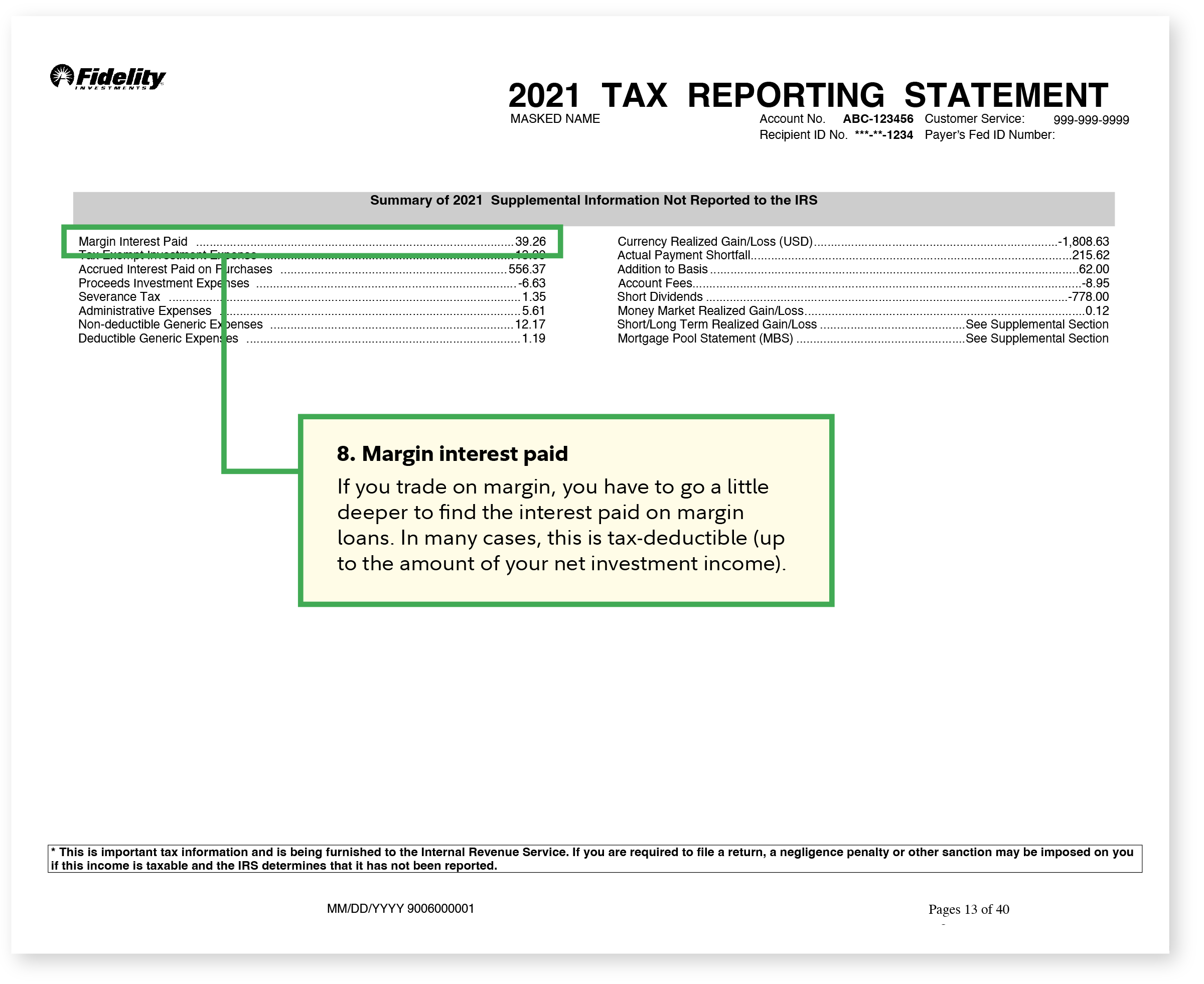

1099 tax form, 1099

Reporting Charitable Contributions on Client Tax Returns Explained

Fiscal Sponsorship for Nonprofits

Who benefits from the deduction for charitable contributions

The 2 Best Online Tax Filing Softwares of 2023

Charitable Deductions: Your 2023 Guide to the Goodwill Donations

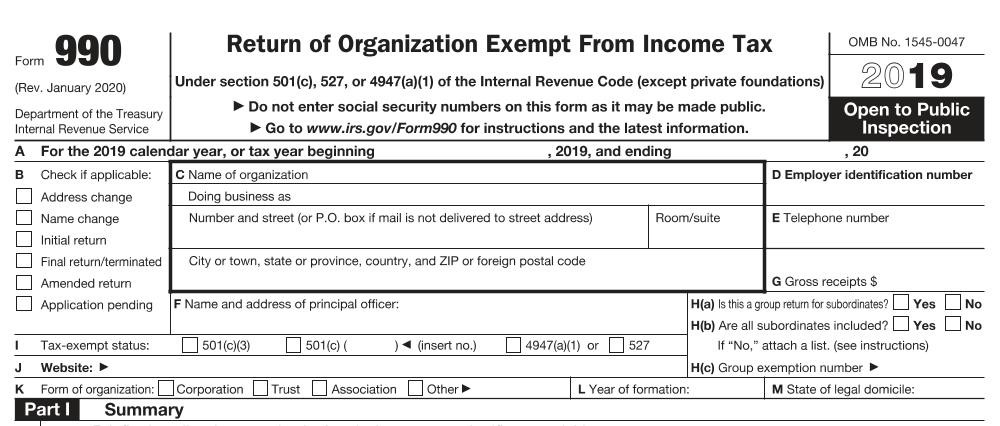

Understanding the IRS Form 990 - Foundation Group®

How the Rich Reap Huge Tax Breaks From Private Nonprofits — ProPublica

IRS Form 8283: Noncash Charitable Contributions

How Charitable Tax Deductions Work

Form 1065: Partnership's Ordinary Business Income & Separately

1099 tax form, 1099

Related products

You may also like

copyright © 2019-2024 richy.com.vn all rights reserved.